Cash App users can receive a Cash Card, which is a debit card tied to their Cash App account. Other features, such as investing and bitcoin, are only available for Cash App users who are at least 18 years of age. Users age 13 to 17 require approval from a parent or guardian to access expanded Cash App features like P2P transactions, direct deposit and a Cash Card. Who Can Use Cash App?Ĭash App is for individuals ages 13 and older. For individuals who frequently use their Cash Card for purchases, this can be a great way to boost savings toward chosen goals without much work. You can turn this feature on or off whenever you want by navigating to your savings balance within the app. This feature lets users with an activated Cash Card round up card transactions to the nearest dollar and automatically transfer the spare change to a Cash App savings balance. Round Ups for SavingsĪnother savings feature within Cash App is called Round Ups for Savings.

Even so, it’s a nice feature for Cash App users who want to set and track savings goal progress within the app. Unfortunately, the savings feature doesn’t earn interest, so there’s no way to maximize your savings potential like you could with the best high-yield savings accounts. To withdraw funds, you’ll first need to transfer the money to your Cash App balance before sending it to an external account. You can contribute to your savings from your Cash App balance or a linked payment source, like a debit card or bank account. To save money using the app, tap on the Money tab, which then lets you create specific savings goals and choose a goal-appropriate emoji. There are no fees or minimum balance requirements associated with Cash App’s savings feature. Users can now set money aside in savings without leaving the app. To add money to your Cash App account, navigate to the app’s banking tab and select “Add Cash.” Enter the decided amount and tap “Add.” Save MoneyĬash App added a savings feature in 2023. Cash App charges a fee for instant transfers (0.50% to 1.75% of the transfer amount, with a minimum fee of $0.25), but you can also choose a standard no-fee transfer, which typically takes one to three business days to complete.

You can keep it there or transfer it to a linked bank account. Transfer MoneyĪny money you receive via Cash App is added to your Cash App balance by default. You can also search for individuals by name, phone number or email address, and you can choose to send funds from your Cash App balance or your linked funding source. You can find individuals and businesses by searching for their $Cashtag in Cash App, then you can request or transfer funds. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.Įach Cash App user creates a unique username, called a $Cashtag. Once a payment source is connected, you can send or receive money through the mobile app. Send and Receive MoneyĪfter setting up a Cash App account, you’ll need to link it to an existing bank account. The app features several tabs for its various services, including banking, debit card, payments, investing and bitcoin. You can also sign up for an account online.

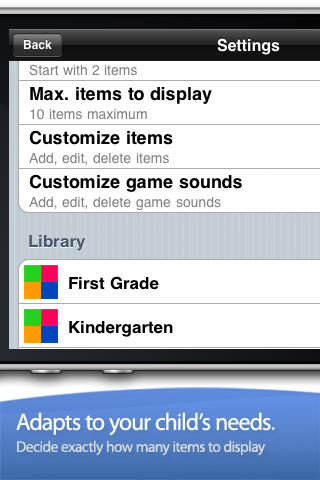

Best site words app download#

To use Cash App, you must first download the mobile app, available for iOS and Android. With this feature, Cash App is quickly becoming a one-stop shop for financial services. With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for free. Consumers can also buy, sell or transfer bitcoin through the app. This is done by buying a portion of a stock, called a fractional share. The investing feature lets users invest in stocks for as little as $1. Through Cash App, users can send and receive money, get a debit card and receive direct deposits. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission as a broker-dealer and a member of the Financial Industry Regulation Authority. The balance in your account is insured by the Federal Deposit Insurance Corporation through partner banks. It provides banking services and debit cards through its bank partners. Block, Inc., formerly Square, Inc., launched the app, initially named Square Cash, in 2013 to compete with mobile payment apps like Venmo and PayPal.Ĭash App is a financial platform, not a bank. Via CurrencyFair's Website What Is Cash App?Ĭash App is a P2P payment app that lets individuals quickly send, receive and invest money.

0 kommentar(er)

0 kommentar(er)